If you would like to speak with someone regarding credit advice, tips and/or consulting, please book a Credit Clarity Call to discuss your specific situation with one of our Credit Specialists. We do not consult outside of a scheduled consultation call. If you are an active client, you are always welcome to message us through your secure client portal, call us or email us during business hours. We do not service clients or consult through any other platforms including our social media accounts.

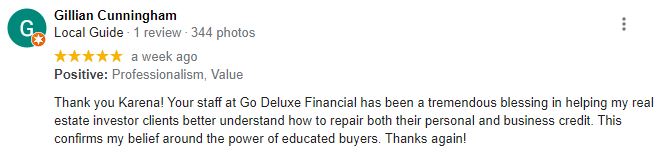

Any items reporting to your credit report that are inaccurate, unverifiable or outdated can be removed from your credit report. This includes collection accounts, charge-offs, late payments, bankruptcies, inquiries, repossessions, judgments, and more.

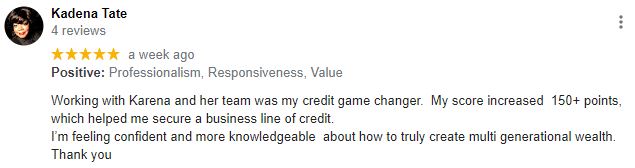

By law, the credit bureaus have to respond to all disputes within 30 days. Although we cannot legally guarantee a specific response or outcome, clients typically begin seeing results within the first 45 days. We have a high success rate!

Yes, credit monitoring is a requirement to initiate and maintain services. There is no other way for us to properly pull and monitor your credit scores each month without it. We do not recommend or accept credit monitoring from sites that provide credit reports for free because they typically do not include all 3 credit bureaus. Feel free to get a head start and sign up for discounted credit monitoring services here.

Each credit bureau has access to different information. As a result, different information creates different scores. The advantage of a 3-bureau report is readily identifying discrepancies: just because you don’t have a collection on one report doesn’t mean it doesn’t exist if another bureau is reporting that collection.

Removing an item from your credit reports does not remove your obligation to that debt. You are still legally liable for the debt and need to settle it if it is within the statute of limitations in your state.

No, credit sweeps are illegal and not an ethical business practice. Legitimate credit repair is a process and it is essential we work together to obtain optimal results in accordance with the law.

By law, we can not guarantee score increases or specific account deletions. However, if you are a client for 4 consistent months (120 days) and have not disputed any accounts 6 months prior to signing up for our services AND have not had any new late payments/collection accounts report to your credit AFTER signing up – you qualify for a full refund of your money paid if we are unable to successfully get any accounts removed or repaired from any of your credit reports. The refund policy does not include your initial audit fee as we conduct an initial analysis and audit of your reports and process all upfront documentation.

There are no contracts as a credit repair client. You may cancel at any time. All cancellation requests must be written and sent via the secure client portal message center or via email to info@godeluxefinancial.com with the subject title “Cancellation Request – First Name, Last Name). All cancellations will be processed immediately. If you request a cancellation after business hours, your request will be processed the next business day.

If you are not an active client, please feel free to contact us during business hours by phone or email info@godeluxefinancial.com. If you are an active client, you may also contact us via the secure client portal which is preferred but not required. All emails and messages will be responded to within 48 business hours.